OSR Reboot: Uniting the Industry for a Sustainable Future

In April 2024, James Warner marked his first full year as Managing Director of United Oilseeds, the UK’s leading independent farmer cooperative. Over the course of that year, he closely observed the ongoing challenges facing the industry, particularly the steady decline in oilseed rape (OSR) production. Just three months later, the OSR Reboot was launched. This ambitious initiative acknowledges the significant hurdles growers have faced in recent years, including pest pressures, market volatility, and unpredictable weather. The Reboot seeks to unite the entire industry, fostering collaboration and innovation to develop solutions that will enhance self-sufficiency and revitalise the future of homegrown OSR.

A not so short open letter kickstarts the campaign!

After securing board approval for investment into the OSR Reboot campaign James Warner set to work on crafting an open letter to United Oilseeds members and the industry, thus creating the first milestone in this groundbreaking campaign. While we all generally want a letter to be short and to the point, particularly when reading it!, the OSR Reboot letter needed to address the multitude of challenges that have impacted OSR production within the UK over the past 10 years. The letter ended up being 6 pages long!

You can download the original letter further down this page.

The Original #OSRReboot letter broken down

In such a short time OSR production has fallen off a cliff here in the UK. Here are just a few of thehadlines that inspired United Oilseeds to step up and change the fortunes of this iconic, cornerstone break crop:

“The UK has the worst-performing OSR yields compared to all 27 EU countries”

“The area of oilseed rape grown in the UK for harvest 2024 will be the smallest since 1984”

“UK food security on edible oils is down to just 20%”

“The UK will import more OSR than it produces for the first time ever!”

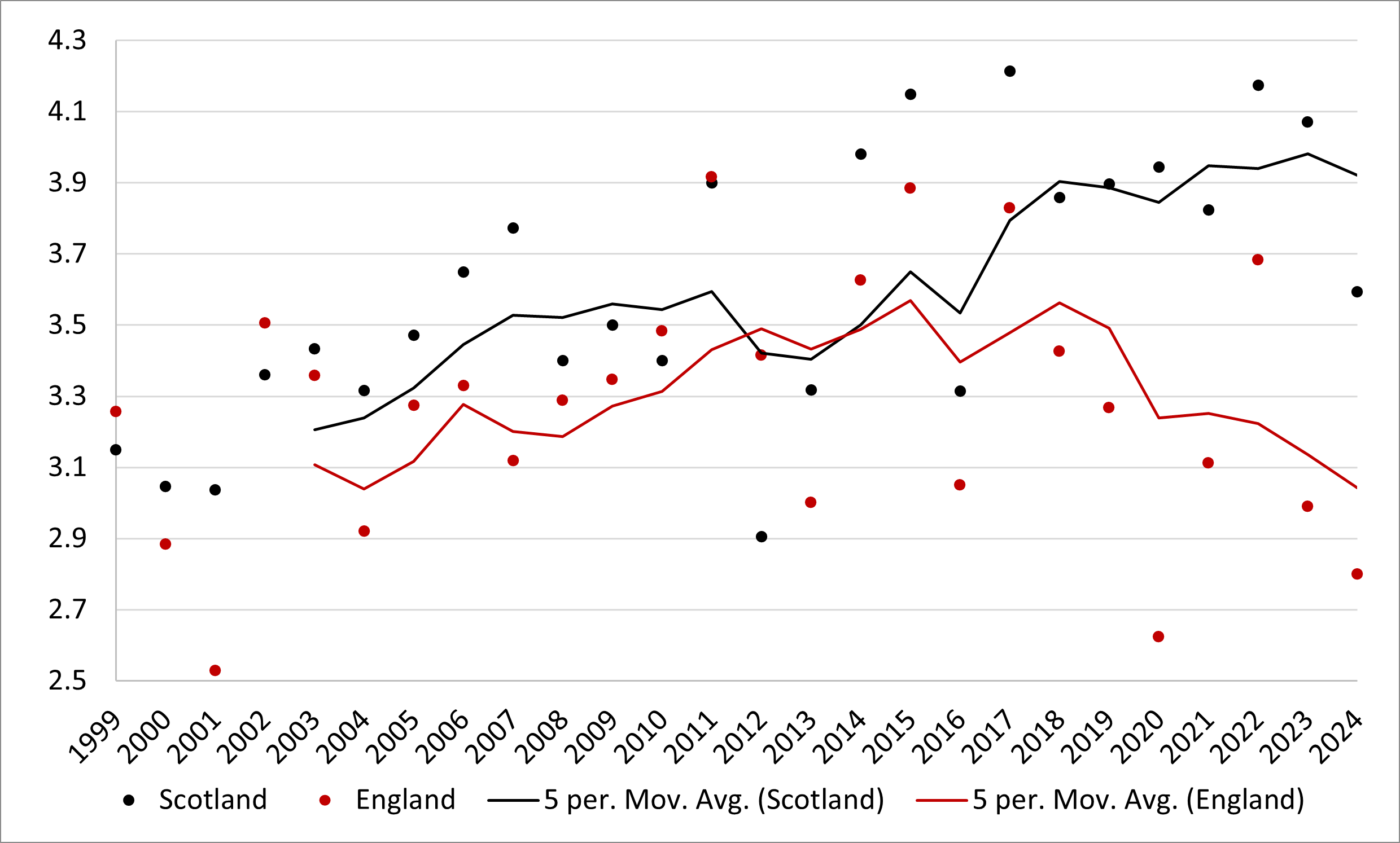

Out of all EU27 (plus the UK) Member States, the UK has been the single worst performing country in terms of average yields. Average OSR yields in the UK have dropped 10%, or 0.36t/ha during the most recent 5-year period when compared to the previous 5-year average. That reflects a pre and post neonicotinoid (neonic) world.

Out of all EU27 (plus the UK) Member States, the UK has been the single worst performing country in terms of average yields. Average OSR yields in the UK have dropped 10%, or 0.36t/ha during the most recent 5-year period when compared to the previous 5-year average. That reflects a pre and post neonicotinoid (neonic) world.

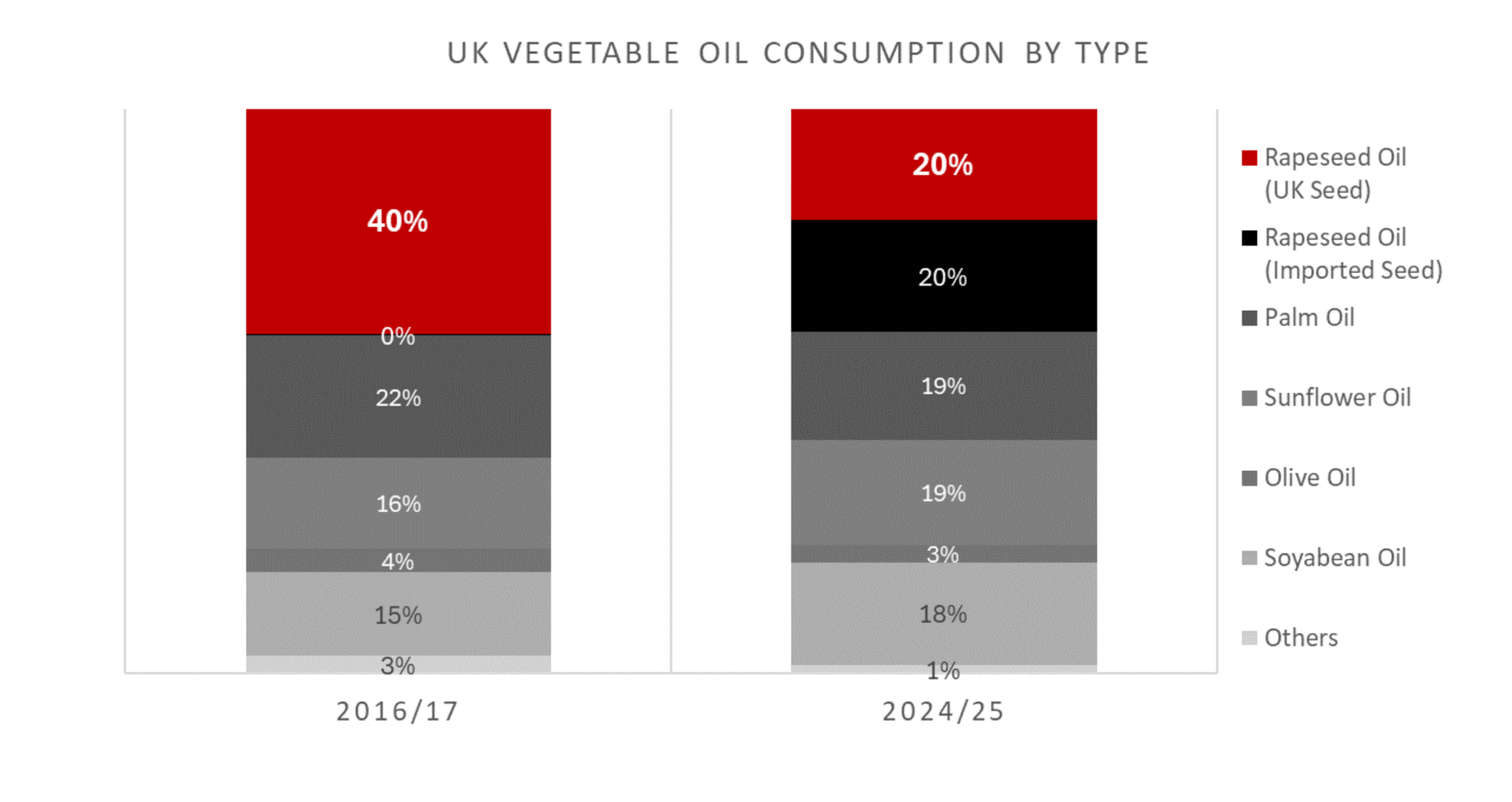

Rapeseed oil is by far the most consumed edible oil in the UK, accounting for 40% of total oil demand. For context, it’s 13 times more important than olive oil. Of all of the major edible oils (rapeseed, sunflower, palm, olive, soy), OSR is the only one that is commercially viable to grow in the UK. We used to be self-sufficient in OSR, meaning we had 40% food security on edible oils (which is already quite low!). However, after the decline in UK OSR production we have seen in recent years, today we produce just 13% of domestic edible oil consumption, relying on imports for the rest. This should be viewed as an emergency position from a food security point of view.

Rapeseed oil is by far the most consumed edible oil in the UK, accounting for 40% of total oil demand. For context, it’s 13 times more important than olive oil. Of all of the major edible oils (rapeseed, sunflower, palm, olive, soy), OSR is the only one that is commercially viable to grow in the UK. We used to be self-sufficient in OSR, meaning we had 40% food security on edible oils (which is already quite low!). However, after the decline in UK OSR production we have seen in recent years, today we produce just 13% of domestic edible oil consumption, relying on imports for the rest. This should be viewed as an emergency position from a food security point of view.

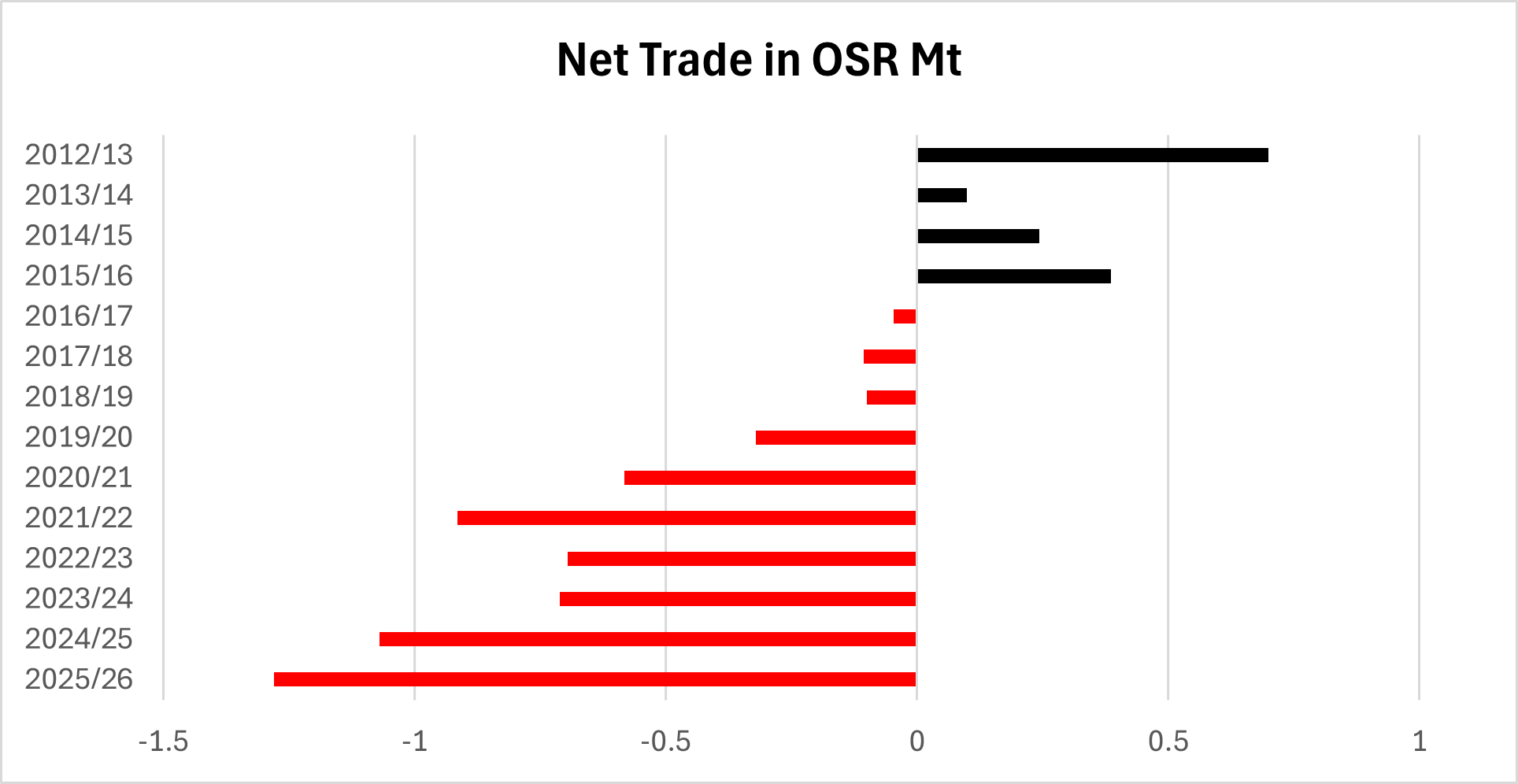

Just wind the clock back to 2012, while the nation was in the grips of hosting the Olympic Games and celebrating the Diamond Jubilee of the late Queen Elizabeth II. You, our members, joined farmers across the country to harvest over 700,000 hectares of oilseed rape, a bumper crop that has been in decline ever since.

Just wind the clock back to 2012, while the nation was in the grips of hosting the Olympic Games and celebrating the Diamond Jubilee of the late Queen Elizabeth II. You, our members, joined farmers across the country to harvest over 700,000 hectares of oilseed rape, a bumper crop that has been in decline ever since.

At our peak in the 2010s, the UK was the 5th biggest exporter of OSR in the world. A decade on and we are now a large importer. The move from exporter to importer will cost a massive £1 billion to the UK economy each year; comparable to the amount pledged in the current Labour manifesto to provide 40,000 more NHS appointments every week; or approximately one-third of the total UK government spend on direct payments to farmers in 2023 (or akin to the predicted revenue generated by the 2024 Taylor Swift UK tour!).

To take a simplistic view, next time you are in the kitchen why not take a look at the ingredients of some of the everyday products we all use? For example, mayonnaise, where a huge 78% of its composition is rapeseed oil. Or next time you use spreadable butter on a piece of toast, check the ingredients, no doubt a significant percentage will be rapeseed oil (and the butter itself would have been from a dairy cow likely fed with rapeseed meal). It’s an important ingredient in salad dressings, crisps, soup, cereal bars, spreads, and biscuits, to name but a few. Not to mention it's also the most widely used oil for cooking.

From a farmer's perspective, there are plenty of reasons to want OSR in the rotation. It offers a true break from cereals in both pests and diseases and benefits subsequent first wheat yields. It improves soil structure, enables an early start to harvest, helps control problem weeds, and offers the potential for early cash flow at the most expensive time of year. And from an animal feed perspective, it offers the UK farming industry a highly nutritious alternative to soy.

From an environmental perspective, the presence of a nutrient dense pollen and nectar source early in the season offers a kickstart to the year for beneficial insects such as bees and hoverflies. You may not be keen on OSR honey but for insects that depend on pollen and nectar to proliferate, not having OSR in a rotation results in a significant deficit in food sources just as colonies are either establishing, in the case of bumble bees, or increasing in size, in the case of honey bees.

As we all know, oilseed rape is very susceptible to crop damage & losses from Cabbage Stem Flea Beetle (CSFB), against which neonics a group of pesticides, previously offered good protection. In 2013, the three main neonicotinoids were banned for all OSR uses both in the UK and the EU (at least in theory), and in all from crops (again in theory) from 2018 onwards.

To date, CSFB has most impacted the southern half of the country, but it has slowly been migrating north, with a sharp increase in issues being seen in the Yorkshire and Humber region this past year. To date, the Northeast and Scotland have been only marginally impacted, with pest population numbers low in those areas so far. But for how long?

As a result, the increased risk experienced by farmers growing the crop is two-fold. Firstly, getting the crop established in the autumn under heavy pest pressure is becoming more and more difficult and secondly, yield losses caused by poor establishment and larval load during crop maturation.

Alongside the practical risks posed by the neonic ban, it has also set the foundation for a very unlevel playing field, something I’ve regularly discussed with members over the past year, and which you are rightly angry about. It’s a classic case of offshoring. The ban on neonics was implemented by the EU/UK with admirable intentions, but all we have achieved is a reduction in the crops we grow in the UK and that supply has been replaced by crops grown elsewhere. If we look at the imports into the UK over recent years, the largest origins are Australia, Ukraine, Uruguay, all of which have access to neonics. Perhaps even more frustratingly, imports have also grown from EU countries (Latvia, Lithuania, Estonia, Romania) which, despite the ban, have been able to use neonics in recent years (completely legally, I must add) due to emergency authorisations & derogations. We banned neonic usage here, but just now import from elsewhere. We haven’t reduced neonic usage, we have just off-shored it.

As many of you will know, I spent several years living abroad, away from the UK market. Upon my return, I have been somewhat surprised by the lack of concerted effort, collaboration, and focus on improving outcomes for OSR across the UK industry. There have been some studies, research, etc. but I would describe efforts as somewhat patchy and piecemeal. Clearly we can no longer drill and pray; we have to change our approach if we are to make the progress that we all desperately want to see.

Firstly, and most importantly, Neonicotinoids are not coming back, and saying anything else is counterproductive to any activity we might undertake with other stakeholders and certainly policymakers. We therefore need to move the conversation forward rather than dwelling on the past.

Having surveyed the agchem companies, it is also clear that there is not any chemistry that will replace the neonics. There is no silver bullet, but I believe that there are a series of marginal gains that will help get us into a more stable situation. United Oilseeds are going to re-double efforts in this area, investing time, as well as capital from our balance sheet, to move things forward.

Post-Harvest Cultivation Initiative – After OSR harvest 2024, United Oilseeds growers were encouraged to try shallow but thorough cultivation to disrupt CSFB lifecycles, potentially reducing emergence by 50-90% based on Niab’s research. Our member poll suggested that 80% tried this technique which may have impacted on the low CSFB numbers seen this year. Get a CSFB update here.

MagicTrap for Pest Monitoring – United Oilseeds partnered with Bayer to roll out MagicTrap, an AI-equipped water trap for real-time pest monitoring. We’ve set up a national network to help growers track pest pressure and make informed drilling decisions. The network is going live again soon for 2025. See more here.

National Stem Larvae Count – 200 farmers from across the UK have sent OSR stem samples to Niab for a national stem larvae count. It is hoped this low cost, quick and practical study will confirm the lower numbers of CSFB this year and help aid on farm decision making for the season ahead. Read the short news story.

Policy & Advocacy – The OSR Reboot formed working groups to focus on breeding, policy and agronomy looking at implementing change within their respective topics. For example, the policy group is lobbying government highlighting the need to support and promote oilseed rape production, and the agronomy team are focused on uniting the industry to provide one single voice in transferring knowledge and best practice, to aid farmers to grow OSR.

Flexible Drilling Dates – Research from NPZ suggests that drilling based on conditions rather than calendar dates is key. Some of the best yields are now coming from crops drilled well into September. United Oilseeds are sharing this type of agronomic updates with our members to

New Chemistry Research – United Oilseeds and industry partners ADM Erith, Frontier Agriculture and Limagrain are funding research into improving plant protection product efficacy, with initial results looking promising. See more here: Enigma V Project.

CSFB & Yield Impact – Beyond establishment risks, larval loads significantly reduce final yields. United Oilseeds continues to sponsor ADAS’s Yield Enhancement Network (YEN) to address this challenge.

Widening the campaign to revitalise OSR production: Featuring in the Saturday Telegraph at the begiining of March was our short article titled Where have all the Yellow Fields Gone. Cath up with the public facing messages on the associated Yellow Fields web page.

BIG WINS FOR THE CAMPAIGN TO DATE

Since starting the OSR Reboot campaign back in the summer of 2024 we've seen some real results that are helping to make a difference for this important home grown crop. Not only are we working hard to lobby on behalf of our members on things like ensuring flowering crops play a part in the proposed new SFI when it comes, but we've also seen some really big wins recently.

Take for example the 10 Management Strategies for Managing CSFB in oilseed rape, a collaboration between all industry partners involved in the OSR Reboot. As far as we're aware this is the first time everyone has come together to share agreed guidance on growing OSR.

The other impressive result is the announcement of £750,000 of funding over the next 4.5 years for additional research into CSFB. The new project named CSFB Research+ is jointly funded by industry reboot partners including United Oilseeds, AHDb and DEFRA. Find out more about the project here.

Yellow fields - Another page worth visiting

If you'd like to take a slightly different (probably briefer) view of the OSR Reboot why not pop along to our 'Yellow Fields' page. Here we explain the impact of our declining yellow fields from a less industry focused perspective. You'll find more ideas of how you can help support oilseed rape production in the UK and in fact ways to support our farmers in general. From looking for the Red Tractor logo when purchasing food in the supermarket, to writing to your MP, every action counts.

Don't forget to spread the word:

#OSRReboot #BringBackYellowFields #BackBritishFarming

OSR Reboot Gains Momentum with 57 Industry Leaders

On 10th September 2024, the inaugural OSR Reboot meeting, hosted by United Oilseeds and led by Dr. Julian Little, brought together 57 key players from across the industry to drive sustainable change for UK oilseed rape. Discussions tackled declining hectarage, unfair global competition, and policy barriers, with insights from AHDB, AIC, John Innes Centre, and ADM Erith. United Oilseeds’ James Warner hailed the collaborative effort, marking the first step in restoring OSR production, food security, and environmental benefits for the UK.

Following the meeting, individual groups have formed focusing on agronomy, policy, and breeding. Each group is actively working to move the debate forward and find practical ways to enhance OSR production.

THE PILLARS OF THE OSR REBOOT CAMPAIGN

The OSR Reboot timeline of events

April 2024

Managing Director James Warner takes the initiative for United Oilseeds to step up and transform the future of OSR production in the UK, planting the seeds for a bold new campaign.

Managing Director James Warner takes the initiative for United Oilseeds to step up and transform the future of OSR production in the UK, planting the seeds for a bold new campaign.

May 2024

James Warner is interviewed on BBC Radio discussing rapeseed oil production, supply, & demand and other edible oil options, following the huge increases in Olive Oil prices.

James Warner is interviewed on BBC Radio discussing rapeseed oil production, supply, & demand and other edible oil options, following the huge increases in Olive Oil prices.

June 2024

The United Oilseeds board of directors approves the OSR Reboot initiative, giving the green light for this important project.

The United Oilseeds board of directors approves the OSR Reboot initiative, giving the green light for this important project.

July 2024

United Oilseeds sends an open letter to members calling for an industry wide OSR Reboot and kickstarting the campaign. They also ask members to complete a post OSR harvest cultivation to limit CSFB emergence.

United Oilseeds sends an open letter to members calling for an industry wide OSR Reboot and kickstarting the campaign. They also ask members to complete a post OSR harvest cultivation to limit CSFB emergence.

August 2024

The Agricultural Industries Confederation (AIC) support the campaign kickstarting collaboration within a leading group of supply chain stakeholders. The national MagicTrap network goes live and weekly pest updates start.

The Agricultural Industries Confederation (AIC) support the campaign kickstarting collaboration within a leading group of supply chain stakeholders. The national MagicTrap network goes live and weekly pest updates start.

September 2024

Farmers, retailers, breeders, research institutes, crushers, agronomists, beekeepers, conservationists, and industry bodies join the inaugural OSR Reboot meeting to discuss OSR Reboot solutions.

Farmers, retailers, breeders, research institutes, crushers, agronomists, beekeepers, conservationists, and industry bodies join the inaugural OSR Reboot meeting to discuss OSR Reboot solutions.

October 2024

The OSR Reboot hits the mainstream press making it into Private Eye magazine, where they call for the government to ban imports of neonic treated OSR.

The OSR Reboot hits the mainstream press making it into Private Eye magazine, where they call for the government to ban imports of neonic treated OSR.

November 2024

The first industry wide Reboot meetings take place, focusing on Breeding, Policy & Agronomy. James Warner presents the Reboot Agenda to the media & industry contacts at the Newbury Press day & we release an article discussing the Carbon Border Adjustment Mechanism (CBAM)

The first industry wide Reboot meetings take place, focusing on Breeding, Policy & Agronomy. James Warner presents the Reboot Agenda to the media & industry contacts at the Newbury Press day & we release an article discussing the Carbon Border Adjustment Mechanism (CBAM)

December 2024

We discuss the decline in CSFB numbers, polling members to understand their sightings, release another article discussing the collaboratively funded Enigma V project and share the Bee-Keepers Association’s OSR Reboot article.

We discuss the decline in CSFB numbers, polling members to understand their sightings, release another article discussing the collaboratively funded Enigma V project and share the Bee-Keepers Association’s OSR Reboot article.

January 2025

A busy month for the Reboot sees James Warner present at the AICC Conference, attend a meeting with environmental NGO’s to discuss the reboot and the release of 5 articles discussing different aspects of the ongoing campaign.

A busy month for the Reboot sees James Warner present at the AICC Conference, attend a meeting with environmental NGO’s to discuss the reboot and the release of 5 articles discussing different aspects of the ongoing campaign.

February 2025

United Oilseeds host the OSR Conference: A Decade of Challenges, A Future of Opportunities with the AHDB. Over 70 guests including farmers, trade representatives and the media attend to see a packed agenda from industry speakers.

United Oilseeds host the OSR Conference: A Decade of Challenges, A Future of Opportunities with the AHDB. Over 70 guests including farmers, trade representatives and the media attend to see a packed agenda from industry speakers.

March 2025

United Oilseeds join forces with Hutchinsons and Agrii to fund the National Stem Larvae Survey to be carried out by Niab on behalf of 200 farms across the UK.

United Oilseeds join forces with Hutchinsons and Agrii to fund the National Stem Larvae Survey to be carried out by Niab on behalf of 200 farms across the UK.

May 2025

The Niab stem larvae survey results are announced and overall the results show there are less flea beetle larvae for most areas than in previous years.

The Niab stem larvae survey results are announced and overall the results show there are less flea beetle larvae for most areas than in previous years.

June 2025

The AHDB and all industry OSR Reboot partners publish joint strategies for managing CSFB in oilseed rape. The first time so many industry partners have come together in this way.

The AHDB and all industry OSR Reboot partners publish joint strategies for managing CSFB in oilseed rape. The first time so many industry partners have come together in this way.

July 2025

£750k NEW 5 year investment announced for research into CSFB. The CSFB Research+ project is jointly funded by industry partners including United Oilseeds and DEFRA.

£750k NEW 5 year investment announced for research into CSFB. The CSFB Research+ project is jointly funded by industry partners including United Oilseeds and DEFRA.

SHORT READS EXPLORING THE #OSR REBOOT THEMES

OSR Reboot: Setting the Scene

The UK’s oilseed rape (OSR) sector is at a crossroads. Since the neonic ban, declining yields and rising imports have threatened domestic production. A collaborative #OSRReboot is essential to restore profitability, sustainability, and a level playing field.

OSR Reboot: Food Security

The UK’s food security is at risk as domestic rapeseed oil production declines. With just a third of UK consumption now homegrown, the OSR Reboot is vital to restoring self-sufficiency and safeguarding national resilience against global supply shocks.

OSR Reboot: Economic Growth

The UK’s shift from OSR exporter to major importer has cost nearly £1 billion annually. The OSR Reboot offers a path to economic recovery, boosting food security, supporting rural economies, and ensuring a fairer playing field for British farmers.

OSR Reboot: Biodiversity

The decline of UK pollinators demands action. Reviving OSR through the OSR Reboot can restore habitats, support biodiversity, and strengthen sustainable farming. Collaboration is key to balancing productivity with stewardship.

OSR Reboot: A Vital Break Crop

Oilseed rape (OSR) is more than a break crop—it’s vital for UK agriculture. From boosting soil health to enhancing food security and sustainability, OSR supports economic growth while reducing reliance on imports. Its revival is essential.

OSR Reboot beginning: Open Letter

James Warner’s open letter urges members to unite for the OSR Reboot, tackling key challenges in UK oilseed rape. He highlights innovation, collaboration, and policy changes needed to restore profitability and sustainability.